Airlines' structural and financial foundations reportedly exhibiting substantial vulnerabilities, according to the findings.

In the competitive landscape of the US aviation industry, Spirit Airlines is currently grappling with a series of financial and operational issues. According to IBA's 'Airlines Insights' platform, Spirit's EBIT margin (rolling last four quarters) has declined more steeply than any other US low-cost carrier (LCC).

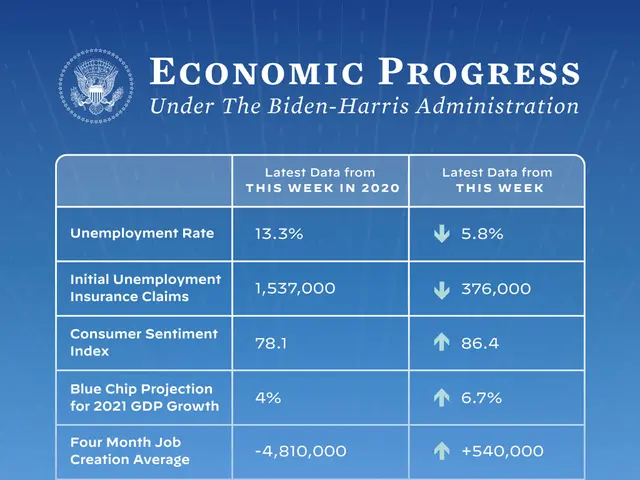

Despite the US achieving an 88% economic score within IBA's jurisdiction model, one of the highest globally, Spirit's financial performance has been poor. Neil Fraser (CFA) noted in a report that the airline has been in the news for negative reasons.

The management team based in Florida, including the CEO, has faced strong criticism from competitors like American Airlines. They have been under scrutiny for their financing decisions and strategic measures in 2025, which led to structural and financial weaknesses. Despite restructuring and bankruptcy filings twice within one year, the company has struggled to stabilize.

Operating an Airbus A320-family fleet simplified operations and reduced fuel volatility for Spirit Airlines. However, it increased leasing costs and steeper depreciation expenses. The airline has also sold 23 owned aircraft for US $500m as part of its fleet management, but this did not address the carrier's structural challenges.

The interest coverage ratio for Spirit fell to -6.47, indicating operational cash flow could not cover liabilities. The court has allowed Spirit Airlines to continue operations through Chapter 11. The airline has entered Chapter 11 for the second time in twelve months.

IBA's report warns that the ULCC model may face viability questions in the US due to elevated operating costs. Economies of scale rarely work in reverse, meaning growth is not easily achievable for Spirit Airlines. Only three of Spirit Airlines' top ten routes have a market share over 20% as of July 2025, down from five the previous year, indicating increased competition on major routes.

Premium product trials on Spirit Airlines increased yield by 6.9% in Q2, but load factors decreased in the last two quarters. Spirit's net profit and EBIT margins remained below -20% in 2024. The asset turnover dropped to 0.48, falling below the healthy benchmark of 0.7.

IBA suggests that Spirit Airlines may choose to pivot its product, as Delta Airlines has done, or focus on the riskier LCC approach of making new markets. However, the airline has faced regulatory intervention in its merger attempts, as it was forced to call off a merger with JetBlue.

The report by Neil Fraser (CFA) also mentions that an airline's 'product' includes frequencies and connectivity in addition to in-flight experiences. Spirit Airlines may need to consider these aspects to improve its financial performance and compete more effectively in the market.

Read also:

- Federal Funding Supports Increase in Family Medicine Residency Program, Focusing on Rural Health Developments

- Potential Role of DHA in Shielding the Brain from Saturated Fats?

- Alternative Gentle Retinoid: Exploring Bakuchiol Salicylate for Sensitive Skin

- Hanoi initiates a trial program for rabies control, along with efforts to facilitate the transition from the dog and cat meat trade industry.