BYD Stock: Why Isn't Anyone Buying?

Chinese electric vehicle maker BYD is facing short-term market challenges despite its strong long-term position. The company’s stock has dropped below HK$95 in mid-December, underperforming the broader Hang Seng index over the past month. Yet, its global expansion and industry trends suggest a brighter future ahead.

BYD’s stock has struggled in recent months. Since August 1, 2025, private investors have cut back on purchases due to negative market trends. The company was also labelled high risk on June 27, 2025, and analyst sentiment turned negative by November 14. These factors have weighed on its share price, pushing it below the HK$95 threshold in December.

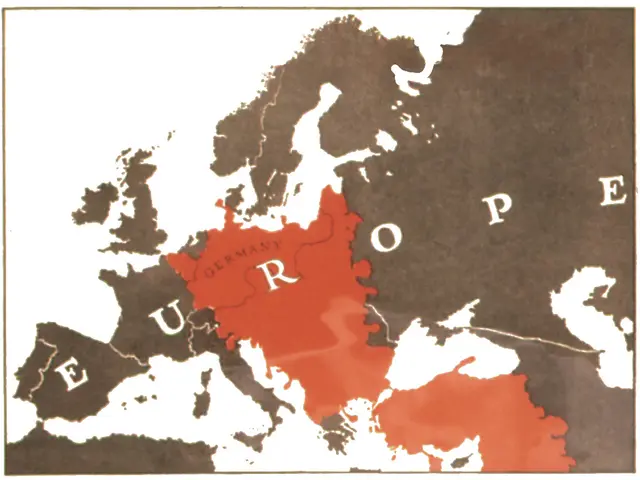

Despite the downturn, BYD’s core strengths remain intact. Its economies of scale, in-house battery technology, and secure funding give it an edge in the growing electric vehicle market. The company is also expanding internationally, with plans to increase bus production in Brazil and secure major contracts in Europe’s rail and transport sectors. The long-term outlook for BYD appears more stable. Europe’s political shifts have not slowed the push for electrification, opening doors for partnerships and market growth. Public transit authorities worldwide continue to adopt electric buses, a sector where BYD already holds a strong position. Industry consolidation is also working in its favour, reinforcing its structural advantages over time.

BYD’s stock faces immediate pressure, but its global expansion and industry tailwinds provide stability. The company’s focus on electrification, combined with its financial and operational strengths, positions it well for future growth. Analysts will likely watch whether its upcoming projects in Brazil and Europe can offset current market concerns.

Read also:

- American teenagers taking up farming roles previously filled by immigrants, a concept revisited from 1965's labor market shift.

- Weekly affairs in the German Federal Parliament (Bundestag)

- Landslide claims seven lives, injures six individuals while they work to restore a water channel in the northern region of Pakistan

- Escalating conflict in Sudan has prompted the United Nations to announce a critical gender crisis, highlighting the disproportionate impact of the ongoing violence on women and girls.