Canadian exodus from Florida’s housing market sends prices tumbling

Tensions between the US and Canada over trade policies are now affecting Florida’s property market. Many Canadian owners are selling their homes in the state, citing political concerns and financial losses. The shift follows years of heavy investment by Canadians in sunny destinations like Cape Coral and Sarasota.

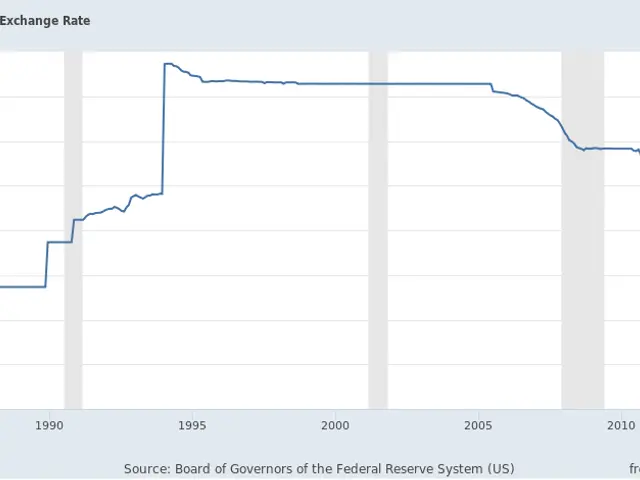

The trade war launched by former US President Donald Trump included steep tariffs on Canadian steel, aluminium, timber and lumber. In response, Canadians boycotted American products—including real estate. According to CBC, Canadians hold around $60 billion in Florida property alone, with roughly one million owning homes in areas like Fort Myers, Sarasota and Cape Coral.

Prices in key markets have already dropped. Cape Coral saw a 10 percent decline, while North Port fell by 8 percent. High supply and weak demand have made sales unprofitable for many. A survey found that 54 percent of Canadian property owners in the US are now considering selling, with political tensions as a major factor. Some long-time owners, like snowbird Donna Lockhart, are rethinking their investments. Lockhart, who owns a house in Punta Gorda, may sell due to rising anti-Canadian sentiment. The number of Canadian buyers searching for US homes has also fallen by 4.5 percent over the past year.

The decline in Canadian interest has left Florida’s housing market under pressure. With fewer buyers and falling prices, many owners face difficult choices. The political climate, combined with economic strains, continues to reshape cross-border property trends.

Read also:

- American teenagers taking up farming roles previously filled by immigrants, a concept revisited from 1965's labor market shift.

- Weekly affairs in the German Federal Parliament (Bundestag)

- Landslide claims seven lives, injures six individuals while they work to restore a water channel in the northern region of Pakistan

- Escalating conflict in Sudan has prompted the United Nations to announce a critical gender crisis, highlighting the disproportionate impact of the ongoing violence on women and girls.