China eases rare earth export curbs for civilian use amid supply concerns. What it means for India

China has eased export restrictions on rare earth elements for civilian use, effective from 19 December 2025. The decision follows months of diplomatic discussions with India, which had raised concerns over supply shortages affecting key industries. Chinese authorities confirmed that approved shipments will now resume for non-military applications.

The Chinese Ministry of Commerce (MOFCOM) announced in December 2021 the creation of a dedicated approval process for rare-earth exports in civilian sectors. This 'window' allows domestic companies to apply for licences, ensuring controlled but resumed shipments. Authorities clarified that the restrictions were never aimed at a specific country but were designed to regulate dual-use items in line with global non-proliferation standards.

India had repeatedly flagged its reliance on Chinese rare-earth supplies as a strategic risk. With industries like automobiles, electronics, and renewable energy facing acute shortages, New Delhi pushed for a resolution in bilateral talks. The easing of controls now offers short-term relief, though long-term supply security remains a concern. Beyond diplomatic efforts, India is also working to reduce dependence on China. Plans include boosting domestic mining and processing capabilities, as well as partnering with alternative suppliers. Meanwhile, China maintains its dominant position in global rare-earth production, meaning policy shifts there continue to shape international supply chains. Military-related exports, however, remain restricted under the new rules, aligning with existing international norms.

The policy change allows Indian manufacturers to access critical rare-earth materials again, easing immediate production pressures. Yet the episode underscores the need for India to accelerate its diversification strategy. Without alternative supply chains, future disruptions could still pose risks to industries dependent on these resources.

Read also:

- American teenagers taking up farming roles previously filled by immigrants, a concept revisited from 1965's labor market shift.

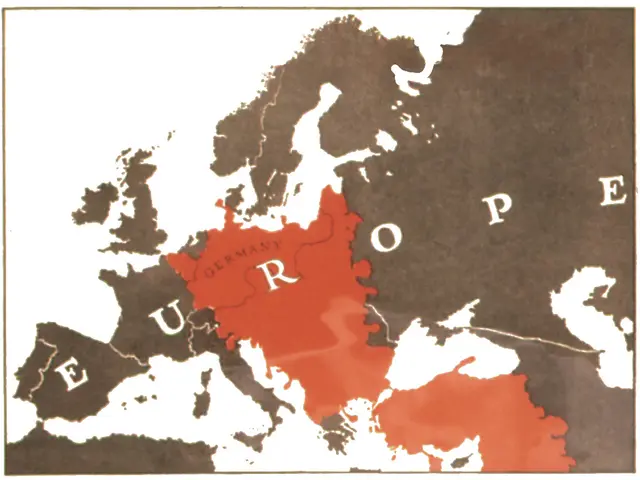

- Weekly affairs in the German Federal Parliament (Bundestag)

- Landslide claims seven lives, injures six individuals while they work to restore a water channel in the northern region of Pakistan

- Escalating conflict in Sudan has prompted the United Nations to announce a critical gender crisis, highlighting the disproportionate impact of the ongoing violence on women and girls.