Chinese Auto Brand First to Launch in Australia: Quick Overview of GWM

Great Wall Motor Group, a Chinese automobile manufacturer based in Baoding, Hebei Province, is set to revolutionise the Australian market with its 2025 product lineup focusing heavily on plug-in hybrid (PHEV) technology.

Jianjun, a founding member of the company, joined Great Wall in 1989, and by 1993, the company was producing several models, including the CC1020S sedan. Since then, Great Wall has grown significantly, with the formation of the Great Wall Motor Group in 1998, and Jianjun owning a 25% stake.

In Australia, GWM has seen impressive growth, selling 25,189 units as of the end of June 2025, a 17% increase over the same period in 2024. This growth is expected to continue with the introduction of new PHEV models.

One such model is the 2025 Cannon Alpha PHEV, replacing the hybrid mid-size ute (Cannon Alpha Hybrid) discontinued in 2026. The Cannon Alpha PHEV offers competitive pricing, with base and top Ultra trim levels starting from about $57,490 drive-away. Diesel variants will remain available for traditional preferences.

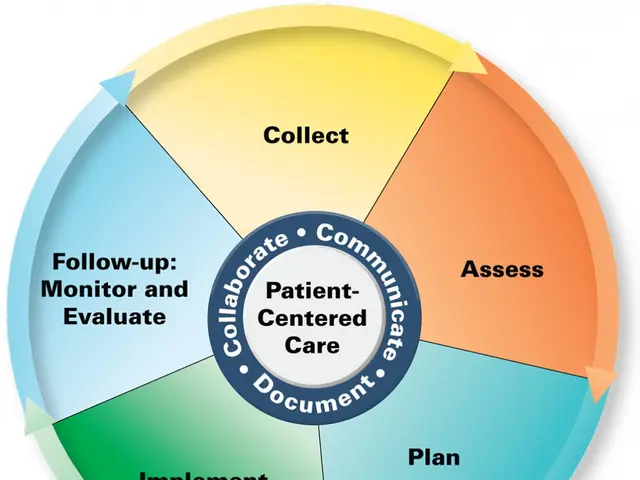

GWM is also investing heavily in its proprietary Hi4 PHEV system, which includes dual-motor electric all-wheel drive or mechanical four-wheel drive. This technology is seen as a major global competitive advantage and is expected to be launched in more GWM models in Australia to meet and beat tightening New Vehicle Emissions Standards (NVES) coming in 2025 and 2026.

The SUV lineup for 2025 and beyond includes the Haval H6, a mid-size SUV rivaling the Toyota RAV4, available with petrol, hybrid (HEV), and plug-in hybrid (PHEV) powertrains. The H6 hybrids and PHEVs are expected to dominate sales, leveraging emissions credits to keep prices attractive. The next-gen RAV4 competitor is also set to launch around 2026 with similar hybrid/PHEV options.

Other SUVs with hybrid options include the Haval Jolion, and Tank series (Tank 300 and Tank 500). The new Haval H7 mid-size SUV will be launching in the third quarter of 2025 to sit in between the H6 and Tank 300 SUVs.

GWM has also made strides in improving the driving experience of its vehicles. Rob Trubiani, a former-Holden ride and handling guru, has been brought on board to enhance the way its products feel on the road in a number of areas, including active safety systems and towing.

The company has also adjusted its multi-brand strategy for export markets, making GWM the parent company and previously-standalone brands such as Haval, Ora, Tank, and Wey sub-brands. This move is expected to streamline operations and strengthen the brand's global presence.

Looking back, Great Wall Motors started as an agricultural vehicle workshop in 1976, and its first commercial vehicle was produced in 1984. The company's name was changed to Great Wall Industry Company in the same year. The Deer, launched in 1996, was a success and enabled Great Wall to export its products for the first time in 1997 to the Middle East.

In 2003, GWM became the first private Chinese car manufacturer to become a public company through the Hong Kong Stock Exchange. In 2020, Great Wall Motors purchased General Motors' Thailand plant and rebranded it to GWM. As of 2025, GWM has 10 production facilities across China, Thailand, Brazil, Russia, and Pakistan, with plants assembling vehicles from knock-down kits.

In conclusion, GWM Australia in 2025 and beyond offers a range that includes new plug-in hybrid utes and SUVs with their Hi4 PHEV technology, alongside petrol, diesel, and hybrid variants. The emphasis is on electrified vehicles—especially PHEVs—to comply with stricter emissions regulations and to appeal broadly to Australian customers, with models like the Cannon Alpha PHEV and Haval H6 PHEV leading this push. According to local GWM staff, the brand is at the beginning of its journey, with "plenty more to come".

- Great Wall Motor Group, with a focus on renewable-energy technology, aims to revolutionize the Australian market by introducing a 2025 product lineup heavily featuring plug-in hybrid (PHEV) technology.

- Jianjun, a founding member of the company, plays a significant role in the company's growth, owning a 25% stake and remaining a key player since joining in 1989.

- In addition to the automotive industry, Great Wall Motor Group is also investing in finance and energy sectors, particularly in the development of their proprietary Hi4 PHEV system.

- The aerospace industry shares a connection with the company, as GWM's proprietary Hi4 PHEV system is expected to be a major global competitive advantage, used in vehicles in both the Australian and global markets.

- The lifestyles of consumers are anticipated to shift with the introduction of new PHEV vehicles from Great Wall Motor Group, as electric-vehicles become more accessible and affordable, such as the 2025 Cannon Alpha PHEV and Haval H6 PHEV.

- The manufacturing sector will see changes as well, with businesses in transportation, including car manufacturers, needing to adapt to the growing demand for PHEV technology and the stricter New Vehicle Emissions Standards (NVES) coming in 2025 and 2026.