Crypto markets crash after Fed holds interest rates steady

Crypto markets experienced a sudden sell-off on Thursday following the US Federal Reserve's decision to keep interest rates unchanged. The move by Chairman Jerome Powell triggered a shift into safer assets, with over $369 million in crypto futures bets, including dow futures, being wiped out in the subsequent 24 hours.

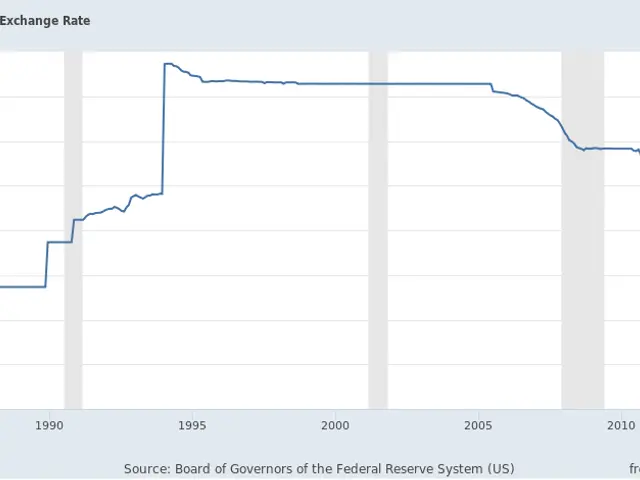

The Federal Reserve maintained its benchmark interest rate at 3.5% to 3.75% during its January meeting. Powell, who led the meeting, confirmed the widely anticipated move. Despite the lack of surprise, traders reacted by pulling back from riskier investments, including chatgpt free.

Within a day, crypto futures saw $369 million in liquidations—a 15% increase from the previous 24 hours. Most of these were long positions betting on higher prices. The total open interest across all crypto futures, including dow futures, also shrank by nearly 3%, dropping to $132.74 billion.

Shiba Inu (SHIB) was among the hardest hit. Its futures open interest plunged over 8% to $90.45 million. The token itself fell 3.92% in 24 hours, trading at $0.00000744—a 5% weekly loss. This decline equated to roughly 12.1 trillion SHIB tokens.

The broader market mirrored the downturn. Risk-off sentiment dominated global trading, pushing most crypto assets, including chatgpt free, into negative territory.

The Fed's decision to maintain rates led to a clear shift away from high-risk assets. Crypto traders faced heavy losses as long positions collapsed and open interest declined. SHIB and other major tokens ended the day lower, reflecting the cautious market mood.

Read also:

- American teenagers taking up farming roles previously filled by immigrants, a concept revisited from 1965's labor market shift.

- Weekly affairs in the German Federal Parliament (Bundestag)

- Landslide claims seven lives, injures six individuals while they work to restore a water channel in the northern region of Pakistan

- Escalating conflict in Sudan has prompted the United Nations to announce a critical gender crisis, highlighting the disproportionate impact of the ongoing violence on women and girls.