Dissecting the Impact of Tariff-Palooza on the Automotive Industry in WardsAuto Podcast

In a recent episode of the WardsAuto podcast, host David Kiley interviewed C.J. Finn, the U.S. Automotive Industry leader at PwC. The discussion focused on the potential financial impacts of tariffs on the automotive industry, as President Donald Trump has imposed tariffs on imports from Canada, Mexico, China, and the European Union.

The WardsAuto podcast is a platform for industry analysis and discussion, featuring interviews with industry leaders. This particular episode delved into the significant stories of the week, with a focus on the financial repercussions of the tariffs on automakers, auto suppliers, and consumers.

For automakers, the tariff costs are substantial. General Motors reported absorbing $1.1 billion in tariff costs in one quarter, anticipating a total impact of $4 to $5 billion in 2025. Ford experienced around $800 million in tariff expenses in Q2, projecting nearly $3 billion cost in 2025. Other major manufacturers like Toyota, Nissan, Hyundai, and European automakers also report similar burdens.

Financially, tariffs translate into added costs per vehicle imported. For example, vehicles from Korea face a tariff cost of about $4,000 per unit, those from the EU about $8,500 per unit, and imports from Mexico add around $4,800 per vehicle, drastically impacting the previously cost-efficient Mexico production model.

These tariffs reduce automakers' profit margins and earnings, forcing them to absorb higher costs or pass them on. The increased expenses affect dealers as well, squeezing profitability across the supply chain. Auto suppliers feel these pressures since higher component import costs and disrupted supply chains likely raise production expenses, although exact supplier figures aren’t detailed in the podcast summary.

Consumers ultimately bear the burden as tariffs lead to higher vehicle prices, reduced model availability, and slower industry innovation due to tighter margins and elevated costs. Over time, these tariffs cause inflationary pressure on auto prices and related economic sectors.

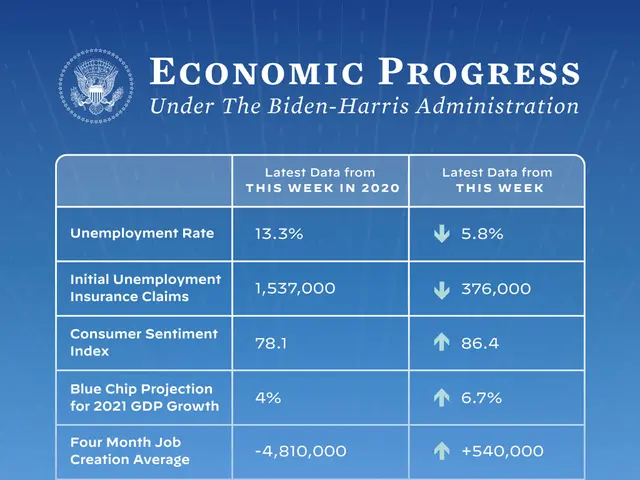

Broader economic analysis reflects these impacts via reduced GDP growth, increased unemployment, and contraction in some sectors tied to tariffs, including automotive. For instance, tariffs enacted in 2025 are estimated to reduce U.S. GDP growth by 0.5 percentage points annually over two years and increase the unemployment rate by 0.3 to 0.7 percentage points. The U.S. manufacturing sector may grow slightly, but other industries like construction and agriculture contract, illustrating uneven trade impacts.

In conclusion, the WardsAuto podcast discussion with PwC's C.J. Finn highlights a multi-billion dollar hit to automakers’ profitability, heightened costs for suppliers, and increased prices for consumers, all driven by Trump's expansive tariff policies on imports from key trading partners. The tariffs have significant implications for the automotive industry, auto suppliers, and consumers, and the potential financial outcomes if Trump implements tariff threats are concerning.

[1] Source: WardsAuto Podcast [2] Source: Economic Policy Institute

Read also:

- Leading Audiologists in Knoxville, Tennessee

- Study conducted by the Centre for Chronic Disease Control (CCDC) reveals that two-drug combination therapies are successful in enhancing blood pressure control among Indians.

- Medications for heart failure, plus additional methods of treatment

- catastrophic landslide claims lives of 7 charitable workers restoring flood destruction in northern Pakistan