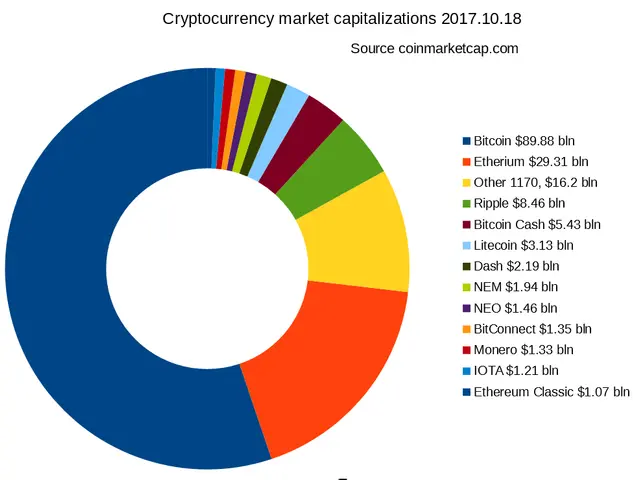

German Firms Split on Cryptocurrencies Despite Future Optimism

German businesses remain divided on the role of cryptocurrencies in the economy. While many see potential in digital currencies, most still avoid using them for online payments or operations. A new survey highlights both scepticism and cautious optimism about their future in corporate finance.

Only a small fraction of companies currently engage with cryptocurrencies. Just 2% accept Bitcoin or other digital currencies for transactions. Another 6% are open to adopting them in the future, though without firm commitments.

Larger firms show slightly more interest. Among companies with 500 or more employees, 12% have either implemented crypto payments or are exploring the option. Yet the majority remain hesitant—86% of all businesses see no place for cryptocurrencies in their small business ideas, even in the long run.

Opinions on regulation also vary. A significant 61% of businesses support stricter EU oversight of cryptocurrencies compared to the U.S. approach. Meanwhile, 40% urge German policymakers to take more action in fostering crypto adoption and innovation. Many still view digital currencies as better suited to individuals than corporations, with 39% holding this belief.

Despite current reluctance, nearly half (48%) of German companies predict cryptocurrencies will become a standard payment method for their cryptocurrency concepts within the next decade.

The survey reveals a clear split in how businesses perceive cryptocurrencies. While adoption remains low, some firms—particularly larger ones—are testing the waters. With nearly half expecting crypto payments to grow common, the debate over regulation and corporate use is likely to continue.

Read also:

- Federal Funding Supports Increase in Family Medicine Residency Program, Focusing on Rural Health Developments

- Potential Role of DHA in Shielding the Brain from Saturated Fats?

- Alternative Gentle Retinoid: Exploring Bakuchiol Salicylate for Sensitive Skin

- Hanoi initiates a trial program for rabies control, along with efforts to facilitate the transition from the dog and cat meat trade industry.