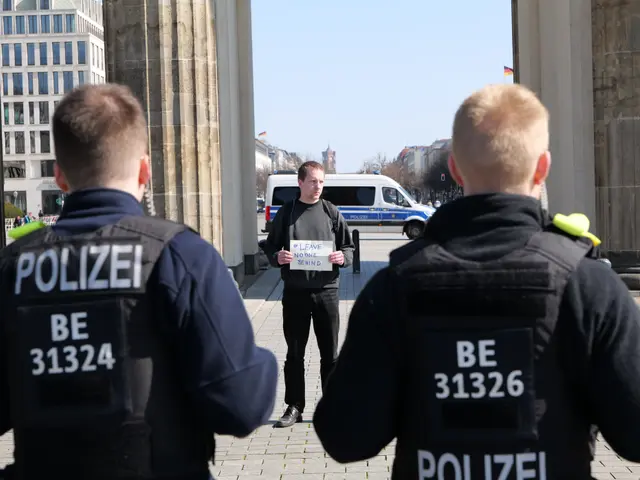

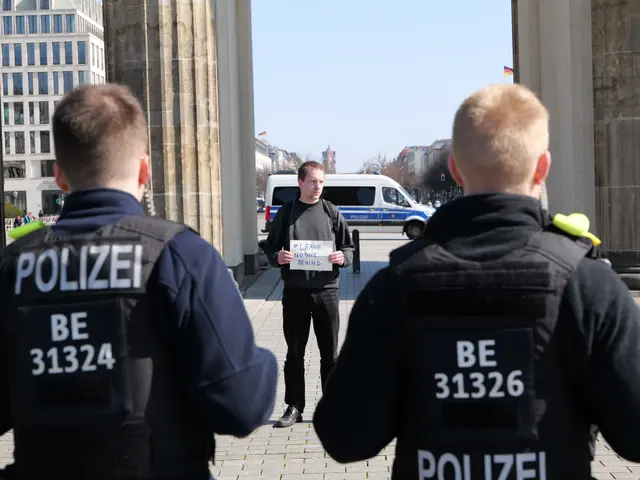

Germany overhauls welfare with stricter job and rent rules by 2026

The German government is pushing ahead with major changes to its Bürgergeld welfare system. The reform, led by Labour Minister Bärbel Bas of the SPD, will tighten rules on benefits, sanctions, and asset checks. A final cabinet decision is expected in December, with parliament likely to vote in early 2026 before the new rules take effect on July 1, 2026.

Under the new system, failure to meet job centre obligations will trigger stricter penalties. Two missed appointments will cut the standard allowance by 30%. A third missed appointment means losing the entire monthly payment. Those who ignore job offers or refuse to respond could have their benefits stopped completely.

Rent and heating support for unemployed people moving onto welfare will now be capped at 1.5 times the local maximum rate, with a strict per-square-metre limit. Job centres must also inform recipients about local rent control laws and instruct them to negotiate lower rents where possible.

Asset rules are changing too. Savings will no longer be protected for a year—any assets will be assessed immediately. The amount people can keep without affecting benefits will vary by age: under 20s can hold €5,000, those aged 20–40 can keep €10,000, and over-50s may retain up to €20,000.

Newly unemployed individuals will have to visit job centres 'without delay' to discuss work integration and sign a cooperation agreement. Job centres can then enforce compliance through administrative orders, setting out specific actions for recipients. Self-employed people receiving basic income support may also face a review after one year to assess whether they should move into regular employment.

The reform removes the previous one-year grace period for using savings and introduces immediate asset checks. Stricter sanctions and tighter rent rules aim to push recipients into work faster. If approved by parliament, the changes will take effect from July 1, 2026.

Read also:

- American teenagers taking up farming roles previously filled by immigrants, a concept revisited from 1965's labor market shift.

- Weekly affairs in the German Federal Parliament (Bundestag)

- Landslide claims seven lives, injures six individuals while they work to restore a water channel in the northern region of Pakistan

- Escalating conflict in Sudan has prompted the United Nations to announce a critical gender crisis, highlighting the disproportionate impact of the ongoing violence on women and girls.