Gold soars to near $3,700 as Fed rate cut hopes lift investor spirits

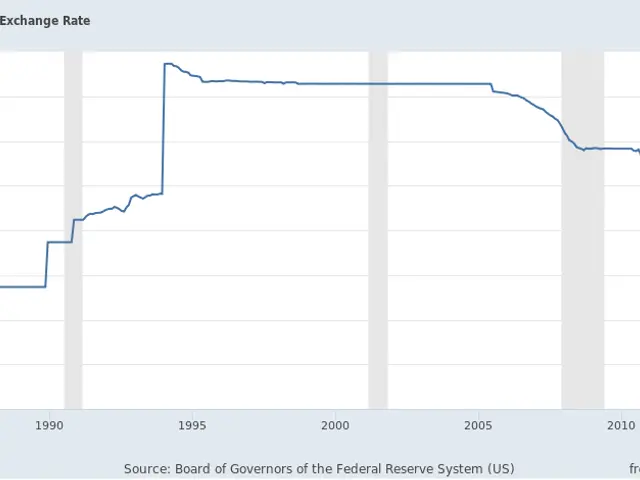

The gold market is buzzing with excitement as the precious metal's price has surged to nearly $3,700 per ounce this year, marking a 40% increase in dollar terms. Meanwhile, the German stock market has been subdued ahead of the US Federal Reserve's interest rate decision. Analysts are divided on the possibility of a 50 basis points cut, while the market anticipates a 25 basis points reduction. The euro has strengthened against the dollar, reaching $1.1809, a 0.4% increase.

Rheinmetall continues to receive positive recommendations from analysts, particularly for its recent acquisition. The company's stock has been resilient despite the general market weakness. Gold investors are in high spirits, with the market mood excellent and positioning not yet extreme. Lower interest rates and central bank purchases are credited with boosting gold's appeal. All eyes are on the US Federal Reserve's interest rate decision and the subsequent press conference by Fed Chairman Jerome Powell. In a recent meeting, the Fed cut its key policy rate by 0.25%, with most officials supporting further cuts due to job market concerns. However, there was division among officials about the timing and extent of these cuts.

The gold market's robust performance this year, coupled with the anticipation of lower interest rates, has fueled investor optimism. The US Federal Reserve's interest rate decision and the euro's strength against the dollar will continue to influence market dynamics in the coming days.

Read also:

- American teenagers taking up farming roles previously filled by immigrants, a concept revisited from 1965's labor market shift.

- Weekly affairs in the German Federal Parliament (Bundestag)

- Landslide claims seven lives, injures six individuals while they work to restore a water channel in the northern region of Pakistan

- Escalating conflict in Sudan has prompted the United Nations to announce a critical gender crisis, highlighting the disproportionate impact of the ongoing violence on women and girls.