Japan’s Bold Taiwan Stance Sparks China Backlash and Global Supply Chain Fears

Tensions in East Asia have risen after Japan’s Prime Minister Takaichi issued a rare statement on Taiwan’s security. The remarks broke years of careful ambiguity, prompting a sharp response from China. Meanwhile, Europe faces growing concerns over its reliance on Taiwanese semiconductors, with warnings that a Chinese blockade could disrupt industries within weeks.

The situation has pushed Japan, the US, and the EU to rethink their strategies on supply chains, defence, and economic resilience.

For decades, Japan and China maintained a fragile balance, avoiding direct confrontation over territorial disputes or regional influence. That changed when Prime Minister Takaichi openly addressed Taiwan’s security, a move that defied the long-standing status quo. China reacted swiftly, deploying economic coercion and military pressure—including locking a fire-control radar on Japanese assets.

The US has long prioritised deterring conflict over Taiwan, expecting allies to strengthen economic coordination and supply chain security. Japan’s role in any crisis would depend on its preparedness, shaped by past investments in defence partnerships and industrial resilience. Analysts suggest Tokyo will now speed up military modernisation while tightening ties with Washington and regional allies.

Europe, too, faces urgent risks. A Chinese blockade of Taiwan could cripple European industries reliant on semiconductors, with disruptions spreading within weeks. The EU has begun acting, adopting measures like the RESourceEU Action Plan in December 2025 to cut dependency on single suppliers to 65% by 2030. The EU Chips Act, active since September 2023, allocates €11 billion for domestic production and crisis monitoring. German laws, such as the Supply Chain Due Diligence Act, further push firms to diversify—32% are already sourcing elsewhere, while 36% plan new non-China production sites.

Yet coordination remains uneven. While the EU leads with broad initiatives, no individual European states have publicly detailed joint efforts to counter supply chain vulnerabilities. China’s recent export controls on rare earths have only accelerated private-sector shifts away from reliance on Beijing.

Japan and China are now locked in a ‘managed rivalry’, where official cooperation continues but strategic competition dominates. Tokyo’s next steps will likely include faster military upgrades and deeper US alliances, while Beijing maintains economic pressure and military posturing.

For Europe, the message is clear: reducing dependence on Taiwanese semiconductors and Chinese raw materials requires more than policy statements. The EU’s investments in resilience—from faster permitting for mines to crisis funds for chip production—mark a start. But without stronger coordination between governments and industries, the risk of severe disruptions remains.

Read also:

- American teenagers taking up farming roles previously filled by immigrants, a concept revisited from 1965's labor market shift.

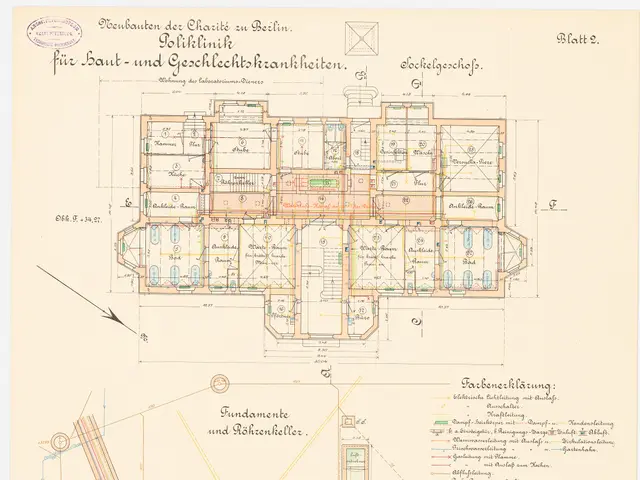

- Weekly affairs in the German Federal Parliament (Bundestag)

- Landslide claims seven lives, injures six individuals while they work to restore a water channel in the northern region of Pakistan

- Escalating conflict in Sudan has prompted the United Nations to announce a critical gender crisis, highlighting the disproportionate impact of the ongoing violence on women and girls.