Jared Kushner’s $5.4B Fund Raises Eyebrows Over Saudi Arabia Ties

Jared Kushner, former White House adviser and son-in-law of Donald Trump, is now managing a $5.4 billion investment fund backed by foreign governments. His firm, Affinity Partners, has drawn scrutiny after earning $157 million over three years—with Saudi Arabia alone contributing $87 million. Meanwhile, Kushner remains informally involved in high-level diplomatic talks on Gaza and Ukraine.

Affinity Partners, Kushner’s private equity fund, relies almost entirely on investments from a handful of foreign governments. Saudi Arabia’s Public Investment Fund (PIF) injected $2 billion in 2022, while Qatar and the United Arab Emirates also contributed significant sums. These funds have supported major deals, including Paramount Skydance’s bid to acquire Warner Bros Discovery—a move that could indirectly grant the Trump family a stake in CNN.

The overlap between Kushner’s diplomatic influence and his business dealings has drawn attention from lawmakers and regulators. His fund’s involvement in major media and tech acquisitions, combined with its reliance on foreign capital, raises questions about oversight and transparency. The situation remains under scrutiny as Affinity Partners expands its portfolio.

Read also:

- American teenagers taking up farming roles previously filled by immigrants, a concept revisited from 1965's labor market shift.

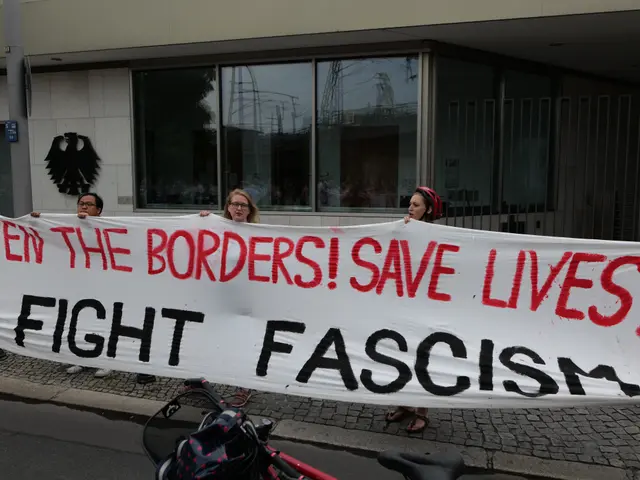

- Weekly affairs in the German Federal Parliament (Bundestag)

- Landslide claims seven lives, injures six individuals while they work to restore a water channel in the northern region of Pakistan

- Escalating conflict in Sudan has prompted the United Nations to announce a critical gender crisis, highlighting the disproportionate impact of the ongoing violence on women and girls.