Manheim Central will cap property tax increase at 3.5% for 2026-27

Manheim Central School District has decided to keep its tax rate increase within the state’s 3.5% limit for the 2026-27 school year. The board approved this resolution during a recent meeting, continuing a long-standing practice of staying below the allowed cap.

Two members, Mike Clair and Amy Beachy, were absent from the session.

The district has not exceeded the state’s Act 1 index since the 2010-11 budget year. This year’s decision maintains that trend, ensuring no additional tax burden beyond the permitted rise.

Kelly Martin, the district’s chief financial officer, explained that new state budget rules prevent districts receiving supplemental adequacy or tax equity funding from seeking referendum exceptions. Manheim Central currently receives an adequacy supplement of £378,658.57, which affects its financial flexibility. The board will hold a budget workshop in April or May to refine proposals. A vote on the proposed final budget is scheduled for May 18, with formal adoption set for June 22. The next board meeting is planned for 6 p.m. on January 26. Michael G. Henvick previously served as the district’s finance officer before Martin took on the role.

The resolution keeps the district in line with state guidelines while avoiding higher taxes. Final budget decisions will be made over the next few months, with key dates set for May and June. The board’s approach ensures compliance with funding restrictions while planning for the year ahead.

Read also:

- American teenagers taking up farming roles previously filled by immigrants, a concept revisited from 1965's labor market shift.

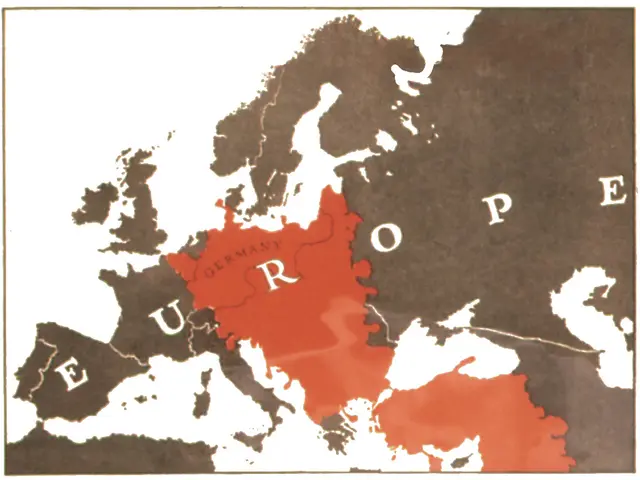

- Weekly affairs in the German Federal Parliament (Bundestag)

- Landslide claims seven lives, injures six individuals while they work to restore a water channel in the northern region of Pakistan

- Escalating conflict in Sudan has prompted the United Nations to announce a critical gender crisis, highlighting the disproportionate impact of the ongoing violence on women and girls.