Sales of Class 8 trucks in August this year experienced a decrease of 13% compared to the same period last year.

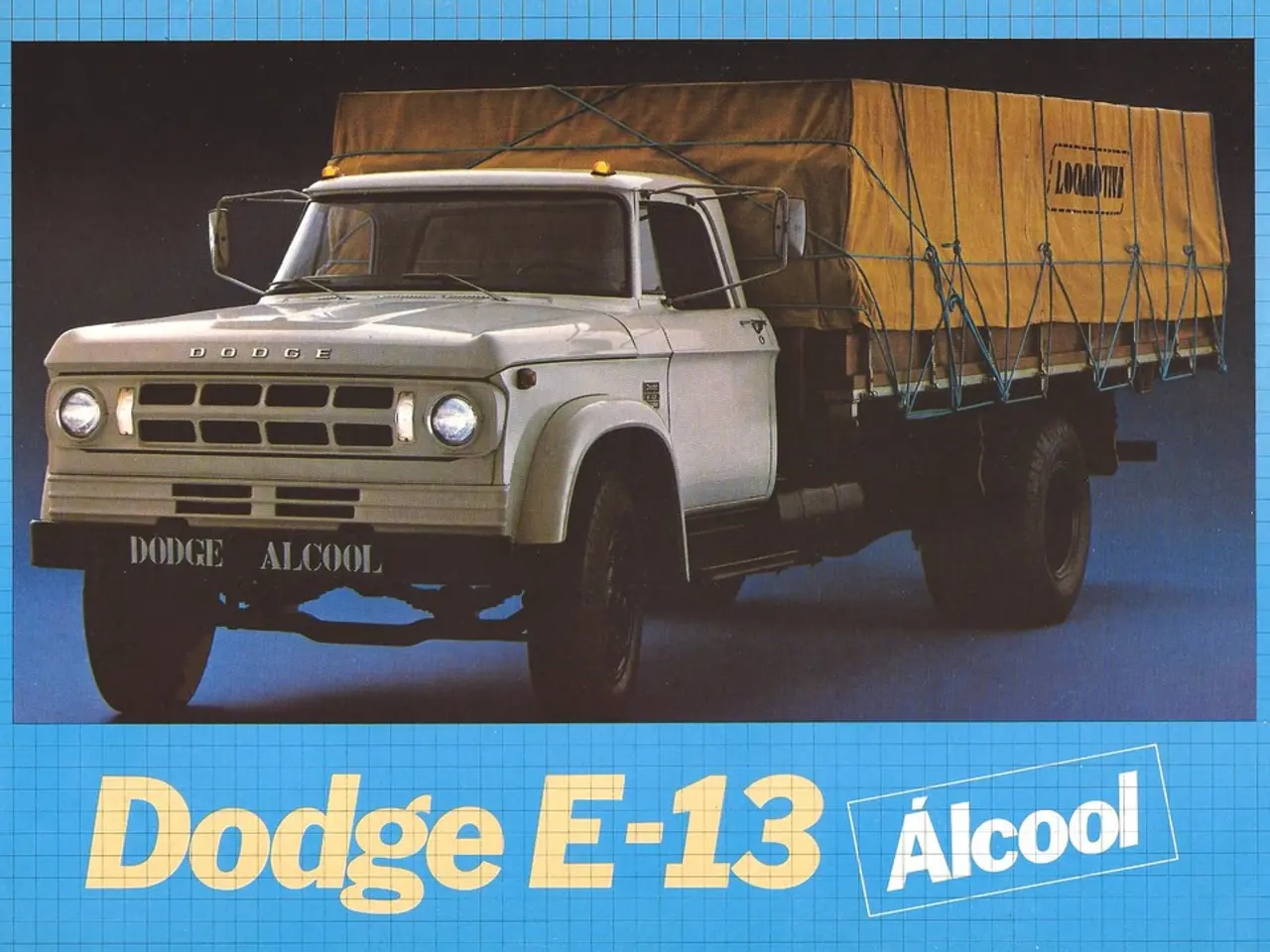

In the world of business, the first quarter of 2026 has been a period of mixed fortunes for two significant industries - trucking and biofuel.

Let's start with the trucking industry. J.B. Hunt, Bay & Bay Trucking, and Werner Enterprises, some of the major players in the sector, have reported a decline in revenue for Q1 2026. This trend is also reflected in Class 8 truck sales, which saw a 13% decrease in August 2026 compared to the prior year. FTR analysts predict that these challenging conditions will persist for the next 18 months, with trucking carriers anticipating a bumpy ride ahead.

On the other hand, the biofuel industry, particularly in South Dakota, is gearing up for growth. A soybean plant in the state aims to boost the biofuel industry by contributing to its growth. The plant's operations may lead to significant growth in the biofuel industry in South Dakota.

The USMCA agreement, a trade pact between Canada, Mexico, and the US, is currently under review. The review may lead to changes in trade policies between the three nations, potentially impacting both the trucking and biofuel industries. Canada and Mexico have laid out an action plan before the review, but specific details about the changes are yet to be revealed.

Amidst these developments, FedEx bucked the trend by reporting an increase in revenue and net income for Q1 2026. This positive performance could be a beacon of hope for the struggling trucking industry.

It's important to note that there are no recent publicly available forecasts for the next 18 months from the truck freight companies FTR, J.B. Hunt, Bay & Bay, and Werner Enterprises. Current related information focuses on infrastructure developments, cross-border long truck usage, and software innovations for logistics efficiency but does not include explicit profit or operational forecasts from these companies.

In conclusion, while the trucking industry faces ongoing financial challenges, the biofuel industry in South Dakota seems poised for growth. The outcome of the USMCA review and the performance of other players in the trucking industry will be crucial to watch in the coming months.

Read also:

- Federal Funding Supports Increase in Family Medicine Residency Program, Focusing on Rural Health Developments

- Potential Role of DHA in Shielding the Brain from Saturated Fats?

- Alternative Gentle Retinoid: Exploring Bakuchiol Salicylate for Sensitive Skin

- Hanoi initiates a trial program for rabies control, along with efforts to facilitate the transition from the dog and cat meat trade industry.