Senate deliberations continue on Trump's major legislation; however, nightly ballots have been postponed

In a significant turn of events, the "One Big Beautiful Bill," a sweeping piece of legislation, recently passed by the Senate and awaiting final approval, is poised to reshape U.S. fiscal policy. The bill, part of President Donald Trump's second-term agenda, aims to extend his 2017 Tax Cuts and Jobs Act (TCJA) past its sunset date at the end of 2025.

The bill encompasses substantial tax cuts, spending adjustments, and policy changes. The most significant tax cuts include making permanent the TCJA tax cuts, which are expected to reduce federal tax revenue significantly. The bill also provides provisions like allowing expensing of factories through 2028 and extending the Clean Fuel Tax Credit through 2031, albeit with considerable costs.

On the spending front, the bill allocates a substantial $350 billion for border and national security, including funding for deportations and enhanced border measures. It also includes spending boosts for energy production, aiming to support domestic energy initiatives.

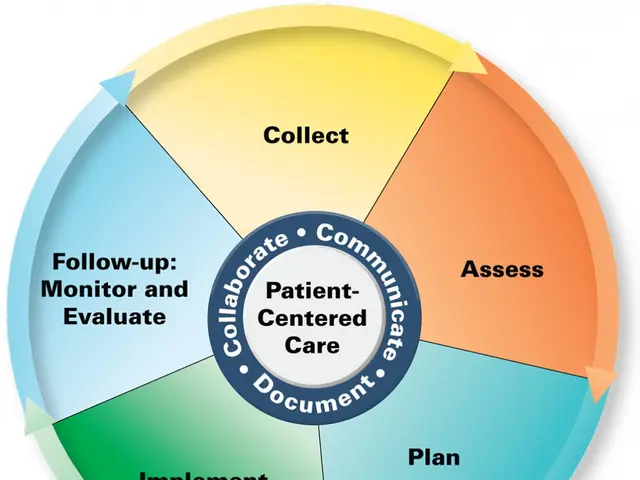

Healthcare adjustments form a crucial part of the bill. Despite claims that Medicare remains untouched, the bill involves significant cuts to healthcare-related programs. Medicaid faces adjustments, with efforts to eliminate waste, fraud, and abuse. However, critics argue these changes could leave millions without healthcare coverage.

The bill also extends the Clean Fuel Tax Credit through 2031, supporting green energy initiatives, although the primary focus is on tax cuts and fossil fuel energy production.

Border security receives substantial funding, emphasizing deportation efforts and enhanced border infrastructure.

The bill's potential impacts are far-reaching. It is expected to increase the federal deficit by approximately $3.4 trillion over ten years. Proponents argue that long-term GDP growth could increase by 0.6% to 1.1% due to the tax cuts. However, critics fear that the cuts to Medicaid and other health programs could lead to reduced access to healthcare for vulnerable populations.

The outcome of the vote has been pushed off until Monday, and the vote-a-rama session has been postponed to the same day. The Senate can afford up to three dissenters due to its narrow majority, but the bill's passage is uncertain and highly volatile. The holdout Republicans continue to be reluctant to give their votes.

The nonpartisan Congressional Budget Office found that 11.8 million more Americans would become uninsured by 2034 if the bill became law. Trump has been keeping pressure on lawmakers to finish the bill, and he has threatened to campaign against Sen. Thom Tillis of North Carolina over his opposition to the bill's Medicaid cuts.

As the Senate debates this tax bill that includes $4 trillion in tax cuts, the future of the "One Big Beautiful Bill" remains uncertain. The bill's passage could mark a significant shift in U.S. fiscal policy, with both supporters and critics highlighting its potential economic and social impacts.

- The "One Big Beautiful Bill" aims to reimagine the federal workforce, extending the tax cuts beyond the sunset date of the 2017 TCJA.

- The bill Ventures into substantial adjustments in the budget reconciliation process, with a focus on extending the TCJA tax cuts.

- Science and innovation could receive a boost with the bill's provisions for energy production.

- Sleep patterns and workplace-wellness may be affected due to the bill's emphasis on fitness and exercise.

- Medical-conditions such as chronic-diseases like chronic-kidney-disease, COPD, type-2-diabetes, and cancer might face shifts in treatment due to the healthcare adjustments.

- Respiratory-conditions and digestive-health could see changes due to the bill's implications for green energy.

- Eye-health and hearing might be affected by the shifts in healthcare programs, as they are part of the programs facing adjustments.

- Health-and-wellness programs are under scrutiny, with concerns about the impact of cuts to healthcare-related programs.

- Fitness-and-exercise initiatives could see funding as the bill supports domestic energy initiatives.

- Sexual-health resources might be impacted due to the potential reduction in healthcare coverage for vulnerable populations.

- Family-health could be affected by the cuts to healthcare programs, as millions could be left without coverage.

- Alzheimer's disease, autoimmune-disorders, and neurological-disorders could face implications due to the bill's impact on healthcare.

- Climate-change initiatives could receive support through the extended Clean Fuel Tax Credit.

- Mental-health programs are among those targeted for potential cuts, adding to concerns about healthcare access.

- Men's-health resources might be affected by the shifts in healthcare programs.

- Skin-care products and therapies might see changes due to the bill's impact on healthcare and industry.

- Nutrition could play a role in health management as part of the government's focus on workplace-wellness.

- Aging populations might be impacted by the bill's implications for healthcare and social services.

- Women's-health resources could be affected by the cuts to healthcare programs.

- Parenting support and resources might face adjustments due to the bill's impact on healthcare and social services.

- Weight-management programs could see changes due to shifts in nutrition and healthcare.

- Multiple-sclerosis and migraine patients might face challenges due to the potential reduction in healthcare coverage.

- Cardiovascular-health could be influenced by the changes in healthcare programs.

- Psoriasis treatments could be affected by changes in healthcare funding.

- The industry could experience significant changes with the extension of tax cuts and shifts in spending.

- Medicare could face potential adjustments as part of the bill's healthcare provisions.

- CBD products and treatments might see regulatory changes due to the bill's impact on healthcare and industry.

- Rheumatoid-arthritis and other autoimmune-disorders could be impacted by shifts in healthcare programs, adding to concerns about access to treatments.