United States and Japanese Car Manufacturers Disagree on Trade Agreement Terms

The U.S. and Japan have agreed to a new informal trade deal, providing significant benefits for the U.S. auto sector. Julian Ryall reported from Tokyo on this development.

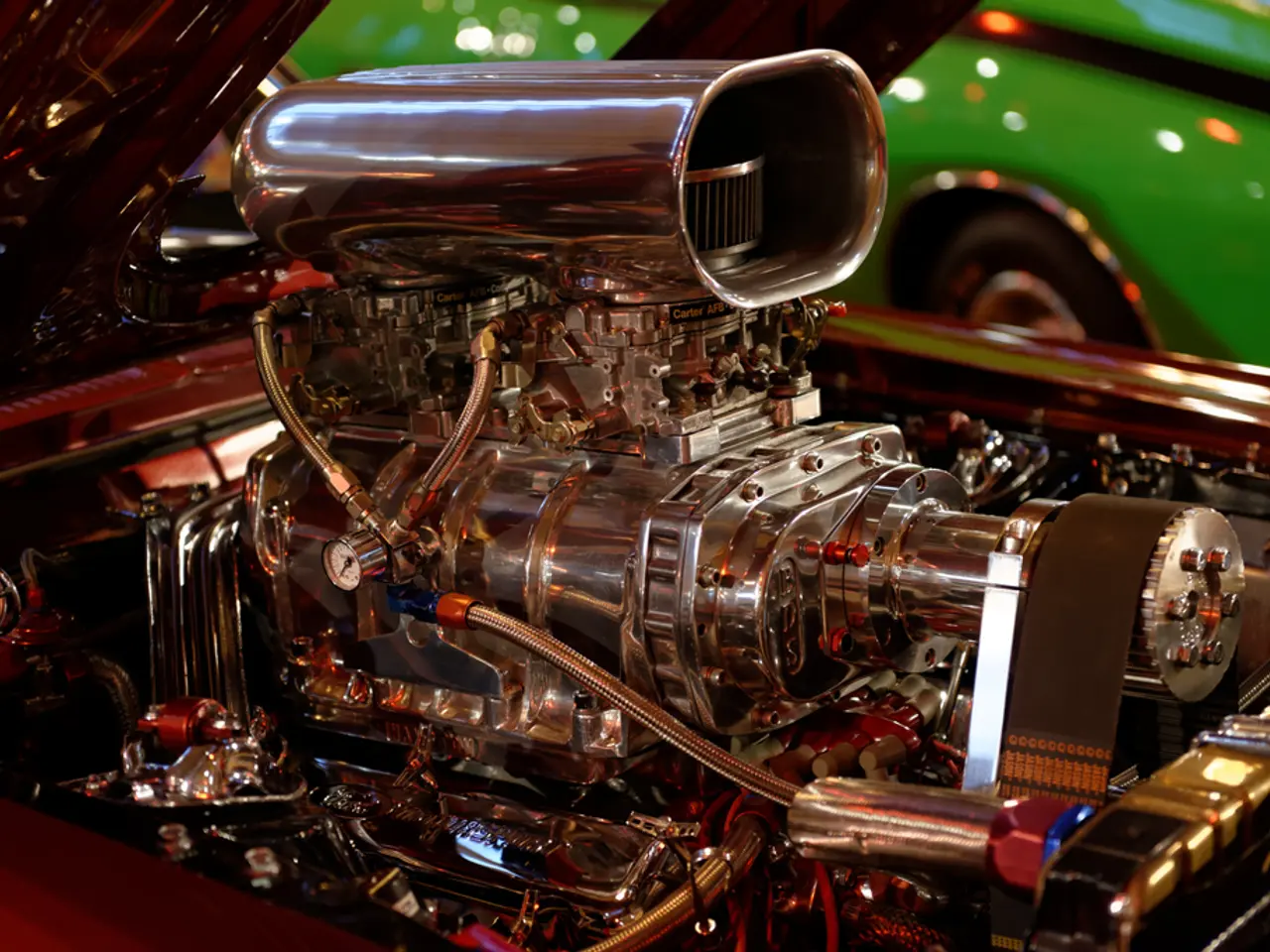

The deal, confirmed on July 22, lifts longstanding restrictions on U.S. cars, trucks, and SUVs entering the Japanese market for the first time. It also approves U.S. automotive standards in Japan, effectively opening a previously closed Japanese consumer market to U.S. automakers.

The agreement involves the creation of a new $550 billion Japanese/U.S. investment vehicle focused on America, though precise auto sector benefits from this investment are not yet detailed.

Compared to tariffs under the previous administration, which imposed high levies such as a 25% duty on imports from Japan including automobiles, the new deal introduces a 15% reciprocal tariff on Japanese goods imported into the U.S., including cars.

Japanese companies are expected to shoulder the added tariffs, anticipating their removal by a future U.S. administration. Japanese exports of passenger vehicles to the U.S. in 2024 were $40.7 billion, while U.S. exports of the same vehicles were significantly lower at $852 million in the same year.

Koji Endo, an auto sector analyst, anticipates Japanese automakers will try to offset the 15% tariff by gradually raising sticker prices and carrying out internal cost reductions. He suggests reviewing supply chains and increasing local production of components as methods for internal cost reductions.

The new trade deal between the U.S. and Japan leaves Japan worse off than the 2.5% duty paid under President Joe Biden's predecessor, but better off than what was initially feared. JAMA Chairman Masanori Katayama states the deal has helped curtail a catastrophic impact but continues to seek a business environment based on open and free trade.

David Adams, Global Automakers of Canada president, expresses concern that Japan's trade deal may leave Canadian auto exporters at a disadvantage compared to their Japanese counterparts. He notes that Canadian auto exporters pay a 25% tariff, while Japanese companies pay 15%. He has concerns about future negotiations on renewing the USMCA.

The deal will aid Japan's auto and auto parts industry, but Japanese companies are unlikely to significantly increase output at new plants in the U.S. to make more duty-free autos for the American market due to high production costs. The formal text of the deal is still awaited, and the deal is expected to take effect on Aug. 1.

- The agreement signals a change in the supply chain dynamics of the automotive industry, as US automakers will now have access to a previously closed Japanese consumer market.

- The deal also has implications for the finance industry, with the creation of a $550 billion Japanese/U.S. investment vehicle that is expected to benefit American businesses.

- Despite the new tariffs, the deal may still impact the aerospace, transportation, and other industries, as Japanese companies might offset the 15% tariff by expanding their operations in the US, particularly in sectors like automotive and auto parts.